Reduce Financial Stress with Hospital Shield

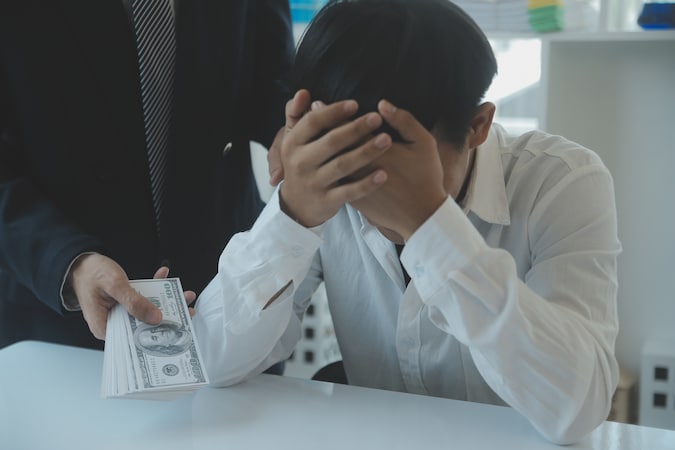

When facing hospitalization, financial stress often compounds the emotional strain of medical care. Hospital Shield provides crucial financial protection, allowing patients to focus on their recovery rather than worrying about mounting bills. With rising healthcare costs, having a financial safety net can be a game-changer in supporting emotional and financial well-being.

SelfGood offers Hospital Shield, a supplemental health benefit designed to reduce financial anxiety during hospital stays. SelfGood provides health insurance solutions that aim to cover the gaps left by traditional insurance policies. In this article, we’ll explore how it works, the emotional benefits, and why financial preparedness is essential for emotional recovery.

Key Takeaways:

- Hospitalization can bring emotional and financial stress.

- Hospital Shield offers financial support by covering expenses traditional insurance may not.

- Financial security can positively impact emotional well-being and recovery.

- Real-life examples highlight the importance of a financial safety net during hospitalization.

Financial Stress During Hospitalization

Hospitalization is a time when emotional stress and financial worries collide. Medical bills accumulate quickly, adding to the anxiety already caused by health concerns. Unfortunately, even with health insurance, many patients face expenses that are not fully covered, such as transportation, lodging, and everyday costs during recovery.

The Emotional Toll of Medical Bills

Beyond the physical challenges of illness, hospitalization brings a heightened emotional toll due to financial uncertainty. The fear of how to manage household bills, combined with mounting medical expenses, leaves patients and their families struggling. Without a financial safety net, these concerns can delay recovery, contributing to anxiety, depression, and even stress-related physical health problems.

How Hospital Shield Provides Peace of Mind

Hospital Shield steps in where traditional insurance falls short. Designed as a supplemental health benefit, it provides cash payments for costs incurred during a hospital stay that may not be covered by typical insurance policies. This includes non-medical expenses like transportation, lodging, and even lost wages.

What is Hospital Shield?

Hospital Shield is a financial buffer that provides peace of mind during hospitalization. It offers direct cash benefits that can be used for a variety of purposes, including covering co-pays, deductibles, and non-medical expenses. This extra layer of financial protection ensures that patients and their families aren’t left worrying about how to make ends meet during recovery.

Financial Stress and Emotional Well-Being

There is a strong connection between financial security and emotional well-being. When financial stress is alleviated, patients can focus more on their physical recovery rather than being preoccupied with financial concerns. By covering the gaps left by insurance, Hospital Shield reduces anxiety and helps foster a sense of emotional peace for both patients and their families.

Real-life Case Studies and Emotional Benefits

The Consequences of Financial Uncertainty

Take the story of Emily, who faced an unexpected medical emergency without supplemental insurance. After her hospital stay, Emily was left with thousands of dollars in uncovered expenses, leading to mounting stress. The pressure of balancing recovery with financial uncertainty significantly impacted her mental health, delaying her return to normal life.

Success Stories with Hospital Shield

In contrast, consider Mark, a father of two who had Hospital Shield coverage. After his surgery, the policy provided cash benefits that helped his family cover lodging, transportation, and household expenses while he recovered. With Hospital Shield in place, Mark and his family could focus on recovery without the additional emotional burden of unpaid bills.

The Psychological Impact of Financial Preparedness

Why Financial Preparation Matters

Financial preparedness plays a key role in emotional health, especially during hospitalization. Knowing that one has a financial plan in place brings a sense of control and security. For patients, this peace of mind translates into better emotional resilience and a faster recovery process. Being prepared with coverage like Hospital Shield allows families to focus on care and support, rather than finances.

More Than Just Financial Security

Hospital Shield provides more than just financial assistance. It supports emotional recovery by removing financial worries, enabling patients to focus entirely on their health. When families don’t have to choose between paying bills and caring for their loved ones, they experience a sense of relief that improves their overall mental well-being.

Frequently Asked Questions

What Expenses Does Hospital Shield Cover?

Hospital Shield covers a range of expenses that are often overlooked by traditional insurance plans. This includes transportation, lodging for family members, childcare, and even lost wages. Additionally, it covers medical costs that insurance may not fully pay, such as deductibles and co-pays.

How Quickly Are Benefits Paid Out?

Hospital Shield aims to provide prompt payouts after a claim is made. This helps alleviate the financial pressure patients face during recovery, ensuring they can cover necessary expenses without delay.

Can Hospital Shield Be Used with Other Insurance?

Yes, Hospital Shield complements existing insurance plans. It provides additional benefits for non-medical and uncovered costs, creating a more comprehensive safety net during hospitalization.

Final Thoughts

Financial stress during hospitalization is an all-too-common experience, but it doesn’t have to be. With Hospital Shield, individuals and families can rest assured that their financial needs are covered, allowing them to focus on what truly matters: recovery. By reducing financial anxiety, Hospital Shield promotes emotional well-being, ensuring that patients and their families can navigate hospital stays with confidence and peace of mind.

For anyone facing potential hospitalization, being prepared with a financial safety net like Hospital Shield can make all the difference. Don’t wait until an emergency strikes—secure your financial and emotional well-being today.

Sources:

- PLOS ONE . (2021). In-Hospital Stress and Recovery Outcomes.

- The Hartford . (2020). Supplemental Health Benefits for Financial Relief.

- Healthcare.gov . (2022). Understanding Health Insurance Coverage.